Reconcile 1099 with Summary and Transaction Report

Every year this comes up in the forums...how do I reconcile my 1099 with my summary or transactions report? (Found here: https://sellercentral.amazon.com/payments/reports-repository/). The information is out there but nonetheless can still be confusing if you haven't done it before.

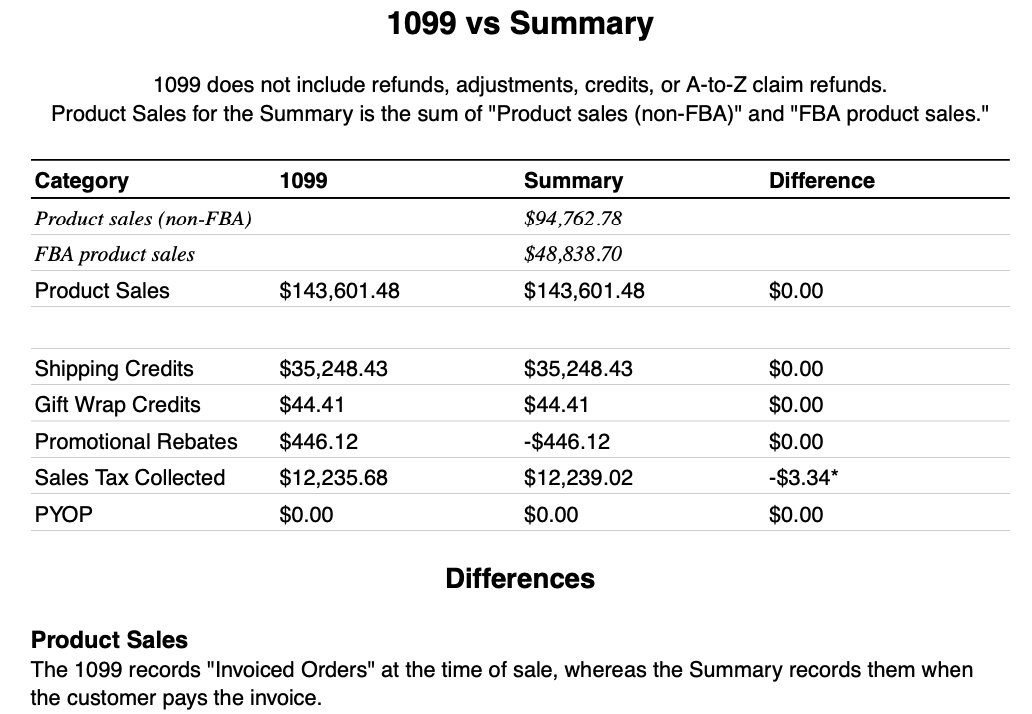

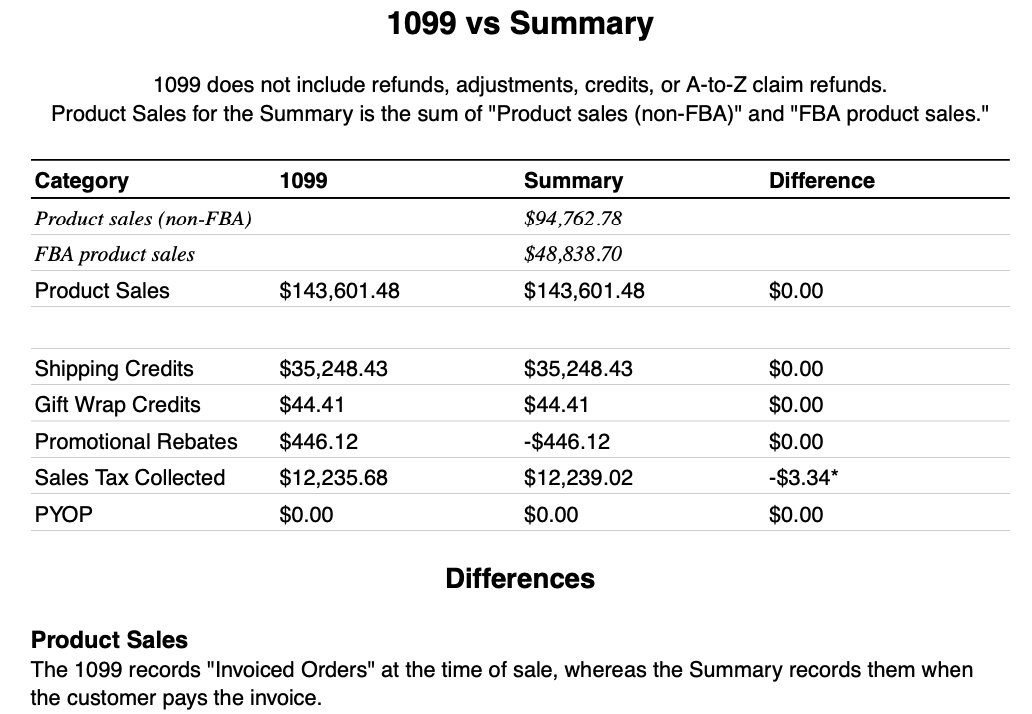

I recently built an automated helper tool for reconciling the 1099 with the summary and transaction report. You feed it your 1099, annual Summary report and (optionally) your annual Transactions (CSV) report, it scrapes the data and generates a PDF report.

The report explains the differences in categories, the reasoning for any discrepancies, and lists your transactions that are causing the discrepancies (invoiced orders, order retrocharge transactions, etc). The idea is you can quickly glean it to learn how the documents reconcile or simply hand it to your tax preparer.

It's currently in beta because I still need to test it on more users. I'm looking for sellers who want to test it out for free. Bonus points if your Summary Report has values for "FBA liquidation proceeds" or "Chargebacks" or "Amazon Shipping Reimbursement". Sample section from the report is attached.

If you're interested, Google search my website "BlueWare Labs". You can contact me through there!

Reconcile 1099 with Summary and Transaction Report

Every year this comes up in the forums...how do I reconcile my 1099 with my summary or transactions report? (Found here: https://sellercentral.amazon.com/payments/reports-repository/). The information is out there but nonetheless can still be confusing if you haven't done it before.

I recently built an automated helper tool for reconciling the 1099 with the summary and transaction report. You feed it your 1099, annual Summary report and (optionally) your annual Transactions (CSV) report, it scrapes the data and generates a PDF report.

The report explains the differences in categories, the reasoning for any discrepancies, and lists your transactions that are causing the discrepancies (invoiced orders, order retrocharge transactions, etc). The idea is you can quickly glean it to learn how the documents reconcile or simply hand it to your tax preparer.

It's currently in beta because I still need to test it on more users. I'm looking for sellers who want to test it out for free. Bonus points if your Summary Report has values for "FBA liquidation proceeds" or "Chargebacks" or "Amazon Shipping Reimbursement". Sample section from the report is attached.

If you're interested, Google search my website "BlueWare Labs". You can contact me through there!

0 yanıt

Seller_CW0P5hgbsiqWX

What you see is correct. The numbers will not match. None of that really matters. What does matter to the IRS is how you file your business taxes. Either by the Cash Method (when the cash is actually received) or the Accrual Method (on the day the transaction took place, no matter if any real money changed hands).

Personally, we use the Cash Method of accounting for our business. We enter the 2-week disbursement when received, not based on the daily selling of individual items.

At the end of the year, Amazon terminates its accounting to sellers on 12-31-2023, and your 1099 is based os sales thru that date. However, this year, my last two weeks of sales will not be paid to me until 1-1-2024. so those 3 weeks of sales will go on the 2024 tax return.

The IRS understands this and is why you have to check the box saying which accounting method you use. Once selected, you do not want to change is every year, the method should stay fixed year to year,

Micah_Amazon

Hello @Seller_HdBBIzm1Np4nR,

This post violates our community guidelines and is considered spam/solicitation. Please review our guidelines in order to make sure you are compliant with our process and protocols.

I will go ahead and close this thread out.

Thank you.

Micah